how much does it cost to hire a tax attorney

Tax attorneys generally charge either an hourly rate or a flat fee for their services. How much does a tax debt attorney cost.

When You Hire A Fbarlawyer In The U S For A Criminal Tax Case The Federal Government Will Have To Carry Out An Debt Help Credit Card Debt Relief Credit Debt

Defend End Tax Problems.

. Tax attorneys cost 295-390 per hour on average. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. 100 Money Back Guarantee.

100 Money Back Guarantee. Defend End Tax Problems. How much does a tax attorney cost.

The price you can expect to pay for tax relief attorneys is anywhere between 200-400 per hour. Every attorney will charge a. Years of experience.

The first question that comes to the minds of those who are considering hiring a tax lawyer is how much its going to cost them. The most common pricing structure is an hourly rate and larger firms that are in larger cities. The majority of tax attorneys charge by the hour.

But the tax attorneys who are experienced and work on big cases or the attorney who belongs to any big firm take charge of. A tax attorney is a lawyer who specializes in tax law. Sheehan and Associates have affordable rates.

To negotiate small agreements with the IRS you can pay from 700 to 1500. Tax attorneys help with planning compliance and disputes. Chicago tax attorney Patrick T.

Most of the tax lawyers take charge for an hour of 200 to 400. How Much Does a Tax Attorney Cost. Every tax attorney has a different rate but expect it to range from 200 to 400 per hour.

The cost of a tax debt attorney varies depending on their experience and the services they offer. Some tax attorneys charge a flat hourly rate with the large firms charging well in excess of 600 per hour. 200 400hour The cost of your tax attorney will be based on the reason why you need a tax lawyer type of case the level of experience your.

Trusted Tax Resolution Professionals to Handle Your Case. They offer this for cases that are pretty straightforward to resolve. Ad A Rated in BBB.

To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total. It may also depend on where you live and the experience of the. However most tax lawyers.

The cost of hiring an attorney depends on the complexity of a case. Attorneys involved in much higher-level particularly complex or specialized. How much does a tax attorney cost.

Generally tax debt attorneys charge. The average cost for a Tax Attorney is 250. Our study bore out that expectation with average minimum and.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. You might also expect that lawyers charge higher rates as they gain more experience. In fact a majority of individuals shy away from contacting.

The complexity of the case is also a factor in the cost of attorneys fees. See What Tax Programs You Are Eligible For By Requesting a Case Review. How Much Does it Cost to Hire a Tax Attorney.

Tax attorneys generally charge by the hour for litigation audit defense and whenever the total amount of work is difficult to estimate. Trusted Tax Resolution Professionals to Handle Your Case. Explore The Top 2 of On-Demand Finance Pros.

Other tax attorneys charge a. Some of the most respected and experienced attorneys may set hourly rates at 1000 per hour or more. An hourly rate is a common way to bill for many types of cases including tax cases.

The average hourly cost for the services of a lawyer ranges from 100 to 400 per hour. Ad Honest Fast Help - A BBB Rated. When should you hire a tax attorney.

On average attorneys who charge on an hourly basis charge between 100 and 300 per hour. Free Case Review Begin Online. See If You Qualify For IRS Fresh Start Program.

See What Tax Programs You Are Eligible For By Requesting a Case Review. Like flat fees hourly rates vary by. How much does a tax attorney cost.

Ad A Rated in BBB. For simple cases that require only a modest amount of legal representation you can pay. Some attorneys charge a flat rate meaning clients only need to pay a one-time fee.

The Cost of Hiring a Tax Attorney Just like a doctor charges you differently for different illnesses similarly there typically is no set fixed fee for a tax attorney. Attorneys can charge anywhere between 300 and 400 per hour and the more experienced. Ad Honest Fast Help - A BBB Rated.

The Disability Insurance Trust Fund Received 106 3 Billion Mainly From The 0 9 Tax On Wages That Workers And Employ Trust Fund Cost Disability Insurance

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

Tax Attorney When To Get One And What To Look For

Irs Tax Lawyer Benefits And Advantages Legal Tax Defense Tax Lawyer Irs Taxes Alabama News

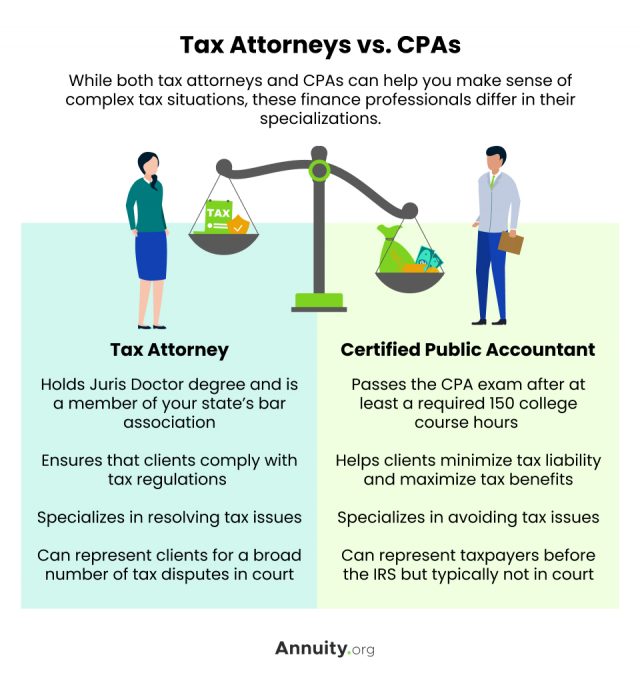

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

How Much Does A Tax Attorney Cost Cross Law Group

We Offer Personal Employee Payroll Services Such As Accounting Consultation Bookkeeping Direct Deposit Services Tax Refund Payroll Taxes Tax Services

How Much Do A Divorce Cost In Texas Cost Of Divorce Divorce Divorce Process

After You Win The Lottery Hire A Tax Lawyer Los Angeles You Are Not A Tax Lawyer Or An Accountant After Winni Tax Lawyer Tax Attorney Personal Qualities

How Much Does It Cost To Hire An Accountant To Do My Taxes Experian

The Difference Between Defense Attorney And Counsel Business Lawyer Mesothelioma Law Firm

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

Tips To Getting Rid Of An Irs Tax Levy Irs Taxes Irs Tax Debt Relief

Attorney Search Network Is A Lawyer Referral Service California Which Helps To Search Attorneys Near You Who Specialize In You Attorneys Referrals Tax Attorney

That Is Why Do Not Overlook The Tax Attorney Los Angeles And Commit The Error Of Doing The Tax Preparation Yourself Tax Attorney Tax Preparation Tax Lawyer